How do cash flow statements help you adjust your budget?

They show your liquidity. That means you know exactly how much operating cash flow you have in case you need to use it. So you know what you can afford, and what you can't. They show you changes in assets, liabilities, and equity in the forms of cash outflows, cash inflows, and cash being held.

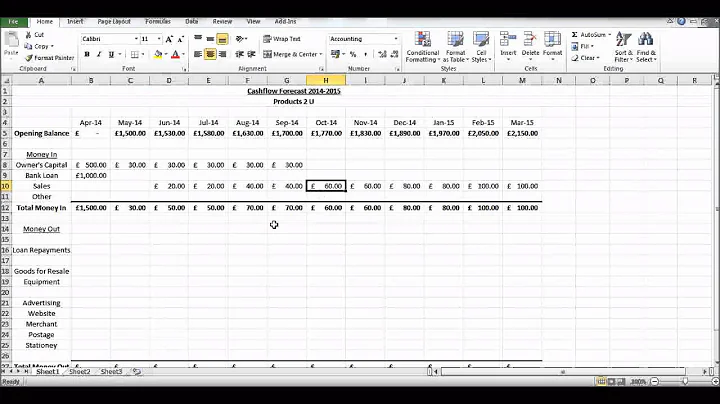

The primary purpose of using a cash flow budget is to predict your business's ability to take in more cash than it pays out. This will give you some indication of your business's ability to create the resources necessary for expansion, or its ability to support you, the business owner.

Creating a personal cash flow statement provides a clearer idea of your financial standing. It also allows you to adjust your spending and seek new income opportunities when necessary. A cash flow statement is commonly used in business to indicate how much money a company is really making.

A cash flow statement is a valuable measure of strength, profitability, and the long-term future outlook of a company. The CFS can help determine whether a company has enough liquidity or cash to pay its expenses. A company can use a CFS to predict future cash flow, which helps with budgeting matters.

The main difference between a budget and a cash flow projection is timing. By preparing both, you are providing a full view of your ongoing business operation. A budget will predict the profitability of your business and a cash flow projection will predict the funds left in your bank account at the end of the period.

A cash budget focuses on forecasting future cash flows, whereas a cash flow statement offers a retrospective examination of a company's historical cash inflows and outflows.

Cash flow and budgeting analysis is an important tool that can make or break the ability of a business to survive. Cash flow statements focus on the amount of money coming in and going out of a business, but also on the timing of transactions in order to minimize peaks and valleys in the availability of cash on hand.

C. It forecasts the amount of money needed to pay expenses and make other purchases.

The statement 'a budget says what will happen with your money, while a cash-flow statement shows what already happened' is true. In the field of business, a budget can be described as the planning of the way in which you decide to use and save your money.

Cash flow is the inflow and outflow of money from a business. It is necessary for daily operations, taxes, purchasing inventory, and paying employees and operating costs. Positive cash flow indicates that a company's liquid assets are increasing.

Why is cashflow so important to a business?

Your operating cashflow shows whether or not your business has enough money coming in to pay operating expenses, such as bills and payments to suppliers. It can also show whether or not you have money to grow, or if you need external investment or financing.

The cash flow statement is broken down into three categories: Operating activities, investment activities, and financing activities.

The statement of cash flows document presents all items of credit or debit much more formally than a cash budget does. While it includes most of the same sources for cash and uses for cash as the cash budget, it may include more refined details about where the cash comes from and how it is spent.

A cash flow budget contributes to more effective cash management. It shows you when additional financing is necessary before the actual need arises. And it indicates when excess cash is available for investments or other purposes.

Cash flow statements, on the other hand, provide a more straightforward report of the cash available. In other words, a company can appear profitable “on paper” but not have enough actual cash to replenish its inventory or pay its immediate operating expenses such as lease and utilities.

A statement of cash flows is useful for detailed financing plans; a cash budget is useful for general financing plans. A statement of cash flows contains forecasted numbers expected in the future; a cash budget reports the results of past.

A cash flow statement summarizes all of the income and outgo (spending) over a certain time period. A budget is a written plan for saving, giving, and spending.

In general, the cash budget allows a business to ensure it can afford to cover its expenses. It provides insight as to how excess amounts may be allocated for use in other areas of the business, such as improvements in production or marketing techniques.

A company will use a cash budget to determine whether it has sufficient cash to continue operating over the given time frame. A cash budget will also provide a company with insight into its cash needs and any surpluses, which help it determine if the business is using cash effectively.

Cash budgets help manage a company's cash flow by simplifying how you track its cash inflow and outflow over time. This can help you determine when to apply for extra financing. It also can help you identify ways to cut back on expenses until more revenue comes in from sales or other sources.

Why is cash flow more important than income?

Profit cannot precisely determine where your business stands, while cash flow can. It cannot be manipulated to show business growth when it's not the case. That's why owners and investors prefer to determine the health of a business based on the cash flow of an organization.

Cash flow is the net cash and cash equivalents transferred in and out of a company. Cash received represents inflows, while money spent represents outflows. A company creates value for shareholders through its ability to generate positive cash flows and maximize long-term free cash flow (FCF).

Positive cash flows mean that more money is coming in than going out of a company. Negative cash flows imply the opposite: more money is flowing out than coming in.

Cash flow positive vs profitable: Cash flow is the cash a company receives and pays, but profit is the total revenue after disbursing all business expenses. Although being cash flow positive in most situations implies that the company is incurring profits, the two aren't the same.

Include the money you spend on everyday expenses, bills, and savings. Also include benefits you use to pay for things that would otherwise be paid for with cash, such as SNAP and TANF. Remember that some benefits may only be used for specific expenses.