How do you create a monthly cash flow forecast?

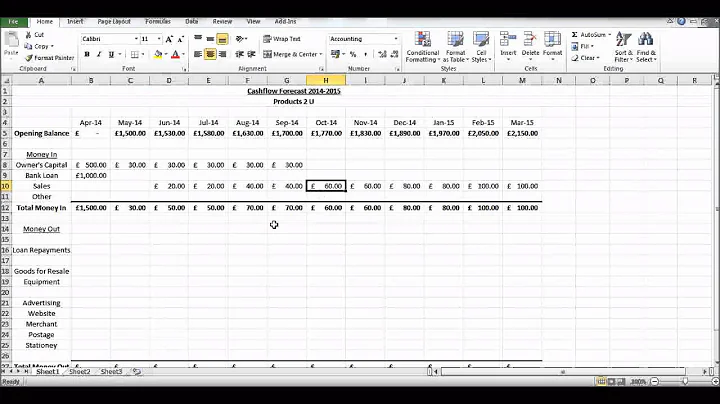

What is a Monthly Cash Flow Forecast Model? The Monthly Cash Flow Forecast Model is a tool for companies to track operating performance in real time and for internal comparisons between projected cash flows and actual results.

- Analyze historical cash flows.

- Estimate future sales and collections from customers.

- Forecast expected payments to suppliers and vendors.

- Consider changes in operating, investing, and financing activities.

- Bootstrap the Business.

- Talk With Vendors to Negotiate Terms.

- Save on Production Cost with Technology.

- Delay Expenses.

- Start a Partner Referral Program.

- Have Operating Assets.

- Send Invoices Early.

- Check Your Inventory.

What is a Monthly Cash Flow Forecast Model? The Monthly Cash Flow Forecast Model is a tool for companies to track operating performance in real time and for internal comparisons between projected cash flows and actual results.

- Define the purpose of a financial forecast. ...

- Gather past financial statements and historical data. ...

- Choose a time frame for your forecast. ...

- Choose a financial forecast method. ...

- Document and monitor results. ...

- Analyze financial data. ...

- Repeat based on the previously defined time frame.

Aiming for $100 to $200 in monthly cash flow per unit is a good goal. For a duplex, you'd want at least $200 per month; for a fourplex, $400 is a good target. This money is what you have left after paying all your bills.

- Choose a time frame and method to use. ...

- Collect basic data and documents. ...

- Calculate balance sheet changes and add them to the statement of cash flows. ...

- Adjust all noncash expenses and transactions. ...

- Complete the three sections of the statement.

Operating Activities

It shows how much cash is generated or used by the company's day-to-day operations. Examples include collecting payments from customers, paying suppliers, and paying wages to employees.

For example, if your cash flow projection for January suggests a surplus of $5,000, your operating cash for February is also $5,000. Below operating cash, list all expected accounts receivable sources—such as sales, loans, or grants—leaving a space at the bottom to add them all up.

Cash flow forecasts should contain four main categories of information: expected income, projected dates for when you'll receive that income, expected costs, and projected dates for when those costs will be incurred.

What are the three 3 major activities in creating a cash flow?

The cash flow statement is the least important financial statement but is also the most transparent. The cash flow statement is broken down into three categories: Operating activities, investment activities, and financing activities.

To calculate operating cash flow, add your net income and non-cash expenses, then subtract the change in working capital. These can all be found in a cash-flow statement.

Drawbacks. The limitations of cash flow forecasts include being unable to account for changing costs, and the accuracy of when money comes into the business. Miscalculations will affect the business which could result in debt.

Monthly forecasting covers the time range of around 10 to 40 days ahead and is really more correctly described as sub-seasonal or extended-range. It is a time scale in between medium-range weather forecasting (10-day) and seasonal forecasting (3 monthly).

Forecasts often include projections showing how one variable affects another over time. For example, a sales forecast may show how much money a business might spend on advertising based on projected sales figures for each quarter of the year.

- Define Assumptions. The first step in the forecasting process is to define the fundamental issues impacting the forecast. ...

- Gather Information. ...

- Preliminary/Exploratory Analysis. ...

- Select Methods. ...

- Implement Methods. ...

- Use Forecasts.

A cash flow forecast is a vital tool for your business because it will tell you if you'll have enough cash to run the business or expand it. It will also show you when more cash is going out of the business than in.

A cash flow statement will provide information on where your business money is coming from and where it's being spent. Over time, your historical performance will also help you to produce a cash flow forecast and spot any challenges and opportunities early.

A monthly cash flow plan or budget gives you more control over your money and sets you up to achieve short-term and long-term financial goals and dreams. It is important to have a zero based cash flow plan which means your monthly income minus your expenses should equal ZERO.

A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. The CFS highlights a company's cash management, including how well it generates cash. This financial statement complements the balance sheet and the income statement.

What are the 3 types of cash flow statement?

- Operating cash flow.

- Investing cash flow.

- Financing cash flow.

Under the “indirect method,” the cash flow statement starts with net income (aka profits) from its income statement, and adjusts for non-cash and non-operating items, to reconcile net income to the net cash flow from operations.

- Enter Your Beginning Balance. For the first month, start your projection with the actual amount of cash your business will have in your bank account.

- Estimate Cash Coming In. Fill in all amounts you expect to take in during the month. ...

- Estimate Cash Going Out. ...

- Subtract Outlays From Income.

There are two ways to prepare a cash flow statement: the direct method and the indirect method: Direct method – Operating cash flows are presented as a list of ingoing and outgoing cash flows.

- Review your income statement and balance sheet.

- Categorize your cash flows correctly. ...

- Use the indirect method for operating cash flows. ...

- Reconcile your cash flows with your bank statements. ...

- Use accounting software and tools. ...

- Here's what else to consider.