How do you make a good cash flow projection?

Use a 13-Week Forecasting Period

A 13-week forecast is also ideal because: It provides ideal visibility for assessing liquidity risk. Since there's usually enough data to provide an accurate view into the weeks ahead, 13-week forecasts help you identify and plan for cash shortages before they become urgent.

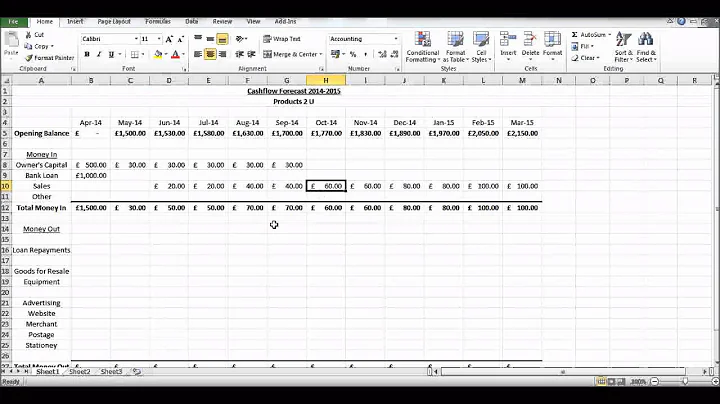

- Forecast your income or sales. First, decide on a period that you want to forecast. ...

- Estimate cash inflows. ...

- Estimate cash outflows and expenses. ...

- Compile the estimates into your cash flow forecast. ...

- Review your estimated cash flows against the actual.

- Automated cash flow data consolidation. ...

- Build different scenarios. ...

- Rolling cash forecasts. ...

- Planning for the right period. ...

- Working capital optimization. ...

- Compare budgeted versus actuals. ...

- Regularly update cash flow forecasts.

Use a 13-Week Forecasting Period

A 13-week forecast is also ideal because: It provides ideal visibility for assessing liquidity risk. Since there's usually enough data to provide an accurate view into the weeks ahead, 13-week forecasts help you identify and plan for cash shortages before they become urgent.

Accounts receivable, average collection period, accounts receivable to sales ratio--while you might roll your eyes at all these terms, they're vital to your business.

- Decide how far out you want to plan for. Cash flow planning can cover anything from a few weeks to many months. ...

- List all your income. For each week or month in your cash flow forecast, list all the cash you've got coming in. ...

- List all your outgoings. ...

- Work out your running cash flow.

With these realistic assumptions in hand, you can begin drafting your cash flow projection. To get started, create 12 columns across the top of a spreadsheet, representing the next 12 months.

Disadvantages of cash flow forecasts

It can't predict the future of your business with absolute certainty. Nothing can do that. Just as a weather forecast becomes less accurate the further ahead it predicts, the same is true for cash flow forecasts. A lot can change, even in 12 months.

In most businesses, there are so many variables outside your control that it is unrealistic to expect a cash flow forecast to be 100% accurate. For example, there be unexpected expenses, some of which may be significant. And, of course, some customers may not pay sales invoices on time.

If you are not already doing so, make sure you assess your cash flow on at least a monthly basis. This will allow you to understand how much money is coming in, what's being paid out, and when to expect these inflows and outflows of cash.

What is a cash flow projection example?

For example, if your cash flow projection for January suggests a surplus of $5,000, your operating cash for February is also $5,000. Below operating cash, list all expected accounts receivable sources—such as sales, loans, or grants—leaving a space at the bottom to add them all up.

Planning for the future, assessing future performance, predicting future goal accomplishments, and identifying cash shortages are the uses of a cash flow forecast.

A cash flow projection model is a comprehensive breakdown of all the money you expect to move in and out of your business over time, considering how certain hypothetical situations may affect cash flow. It lets you see your current working capital and your zero cash date.

A projected cash flow statement is best defined as a listing of expected cash inflows and outflows for an upcoming period (usually a year). Anticipated cash transactions are entered for the subperiod they are expected to occur.

A 12-month cash flow forecast shows a company its expected liquidity situation, i.e. how high its income and expenses will be in the next 12 months. This corresponds to long-term liquidity planning and is an important planning tool for start-ups as well as for companies already firmly established in the market.

Cash flow statements show the actual cash inflows and outflows for a past period. In contrast, cash flow projections estimate the expected cash inflows and outflows for a future period.

Cash flow forecasts and cash flow projections are essentially the same thing. Both are financial planning tools that small business owners use to predict their future cash position. The main difference is the time frame they forecast on. Generally, cash flow forecasts are used for short-term planning.

- Under-committing. Cash flow forecasting is one of the most important business management tools. ...

- Inaccurate data. ...

- Lack of communication. ...

- Not considering different scenarios. ...

- Late loans.

How to Calculate Free Cash Flow. Add your net income and depreciation, then subtract your capital expenditure and change in working capital. Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure.

Why is cash flow forecasting important? Cash flow forecasting is important because it enables businesses to make informed strategic decisions by having an accurate picture of what their cash position looks like in the future.

How do you create a projection model?

- Open an Excel sheet with your historical sales data.

- Select data in the two columns with the date and net revenue data.

- Click on the Data tab and pick "Forecast Sheet."

- Enter the date your forecast will end and click "Create."

- Title and save your financial projection.

Cash flow projections show the amount of cash on hand at the beginning and at the end of each month. For example, Company XYZ has the following projected income and expenses for the month of January: At the beginning of January, a company has $10,000 in cash. Income for the month is projected to be $30,000.

1. Begin with the total project budget. The process begins by considering the total budget or cost of the project. This figure is the foundation upon which all cash flow projections are based.

To create a cash flow projection, you'll need to determine the time frame, calculate all revenue and costs, and create a simple chart to fill in all financial data for corresponding months or weeks.

A projected 3-year cash flow is a financial statement that outlines the anticipated cash inflows and outflows for a business over a specific three-year timeframe. It takes into account factors such as sales revenue, expenses, investments, loan repayments, and other sources.