How do you measure a company's cash position?

An organization's cash position is usually analyzed through liquidity ratios. For example, the current ratio is derived as a company's current assets divided by its current liabilities. This measures the ability of an organization to cover its short-term obligations.

Calculate inflows and outflows by analyzing the bank statements, sales revenue, OPEX, loan repayments, investments, and other relevant transactions. Determine the current cash position by summing up the inflows and subtracting the outflows from the previous cash position.

The most effective way to track your company's cash flow is through a cash flow statement (or report). It enables you to get an overall view of all money that has come in and out of your business's bank account, and basically to understand your company's cash position (whether it is positive or negative) every month.

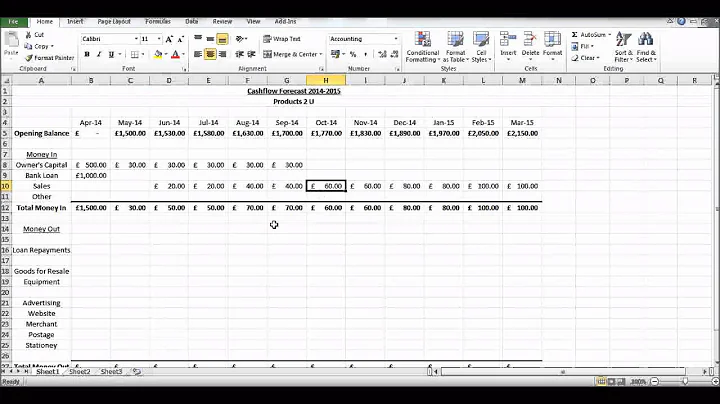

Cash flow forecasting is a cash projection process to estimate the financial position of a business over a specific period of time in the future and is measured by comparing the cash in- and outflows of the business.

- Net Cash-Flow = Total Cash Inflows – Total Cash Outflows.

- Net Cash Flow = Operating Cash Flow + Cash Flow from Financial Activities (Net) + Cash Flow from Investing Activities (Net)

- Operating Cash Flow = Net Income + Non-Cash Expenses – Change in Working Capital.

Although there is no ideal figure, a ratio of not lower than 0.5 to 1 is usually preferred. The cash ratio figure provides the most conservative insight into a company's liquidity since only cash and cash equivalents are taken into consideration.

A cash flow statement shows the exact amount of a company's cash inflows and outflows over a period of time. The income statement is the most common financial statement and shows a company's revenues and total expenses, including noncash accounting, such as depreciation over a period of time.

4 examples of cash position

Cash in hand: This includes physical currency and coins that a company has on hand, such as cash in a cash register or petty cash fund. Bank accounts: It involves funds held in checking accounts, savings accounts, and other deposit accounts at banks or other financial institutions.

Daily Cash Report or Cash Position Worksheet is used to report on the current day bank balance and helps with active cash management. This report is primarily driven by the intraday bank statement.

Add up the cash you received from yesterday's business operations. Count the cash in each of the cash registers. Make a separate entry on the daily cash position report for each register. Add up and enter the total amount of cash from all the registers on the daily cash report.

How can you measure cash forecasting accuracy?

All accuracy measurement is based on an actual versus forecast calculation. This calculation involves comparing a forecast cash position or flow to the actual cash position or flow, when it is known.

Cash Forecasting Methods

There are three time periods used to develop forecasts: short-term, medium term, and long-term. We'll talk about the different purposes of each period below, and provide you with some key points to consider that are unique to each one.

To calculate the closing balance, use the formula: Closing Balance = Opening Balance + Incoming Funds – Outgoing Expenses ± Non-Cash Items ± Outstanding Transactions.

An operating cash flow ratio of less than one indicates the opposite—the firm has not generated enough cash to cover its current liabilities. To investors and analysts, a low ratio could mean that the firm needs more capital. However, there could be many interpretations, not all of which point to poor financial health.

Long-term debt is not included. A higher cash ratio indicates more liquidity to handle short-term debt. However, holding excessive cash can be inefficient if it sits idle rather than being reinvested in growth opportunities. Most analysts recommend a cash ratio between 0.2-0.5.

A balance sheet is a summary of the financial balances of a company, while a cash flow statement shows how the changes in the balance sheet accounts–and income on the income statement–affect a company's cash position.

Types of Financial Statements: Cash Flow Statement

The cash flow statement (CFS) measures how well the company generates cash to pay its debts and fund its operating expenses and investments.

Regardless of whether the direct or the indirect method is used, the operating section of the cash flow statement ends with net cash provided (used) by operating activities. This is the most important line item on the cash flow statement.

If the ratio is above one, the cash position reflects that the company has enough funds to continue its operating activities. In contrast, a ratio below one shows a weaker cash position of a company.

If your business's current ratio and quick ratio are both greater than one, there's a high likelihood that you have a good cash position. That's because you have enough current assets and liquid assets to cover your current liabilities.

What is a positive cash position?

Positive cash flows mean that more money is coming in than going out of a company. Negative cash flows imply the opposite: more money is flowing out than coming in.

Cash is the cash that flows in and out of a business during a specific period. Vs. Profit is revenue less expenses during a specific period. Profit is essential for a business to grow.

There is probably an infinite number of forecast accuracy metrics, but most of them are variations of the following three: forecast bias, mean average deviation (MAD), and mean average percentage error (MAPE).

Key metrics for evaluating a time series forecasting model include Mean Absolute Error (MAE) for average absolute errors, Root Mean Squared Error (RMSE) to highlight larger errors, Mean Absolute Percentage Error (MAPE) for error in percentage terms, R-squared (R²) for the variance explained by the model, and Forecast ...

Some common forecasting accuracy metrics include Mean Absolute Error (MAE), Mean Squared Error (MSE), Mean Absolute Percentage Error (MAPE), Mean Percentage Error (MPE), and Mean Absolute Scaled Error (MASE). Each metric has its advantages and disadvantages based on the context of the forecast.